A new survey by The Meeting Professional exploring the near-future business landscape as we, hopefully, move closer to a post-coronavirus world, has received more than 400 responses (during the week of April 13). The survey remains open, but due to the timeliness of the data, we feel it’s important to share the information gathered thus far from a respondent pool of 55% planners and 41% suppliers.

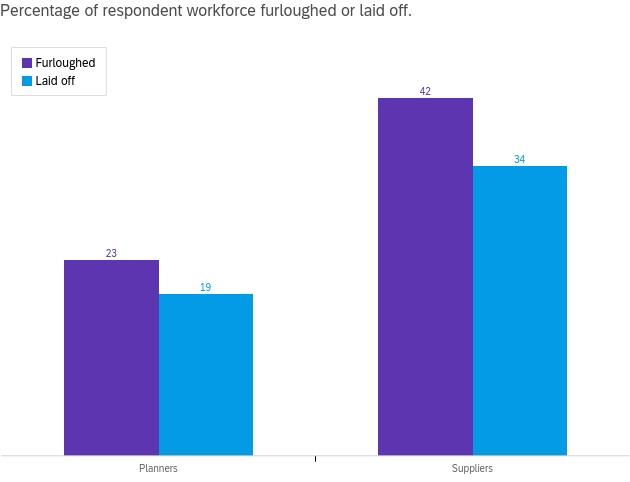

Furloughs and Layoffs

Overall, respondents report 58% of the staff at their organizations have been furloughed (32%) or laid off (26%). As horrific as those figures are, suppliers have been hit much harder with a total of 76% of staff furloughed (42%) or laid off (34%). [Planner respondents indicate 23% of staff furloughed and 19% laid off.]

Recovery Timing

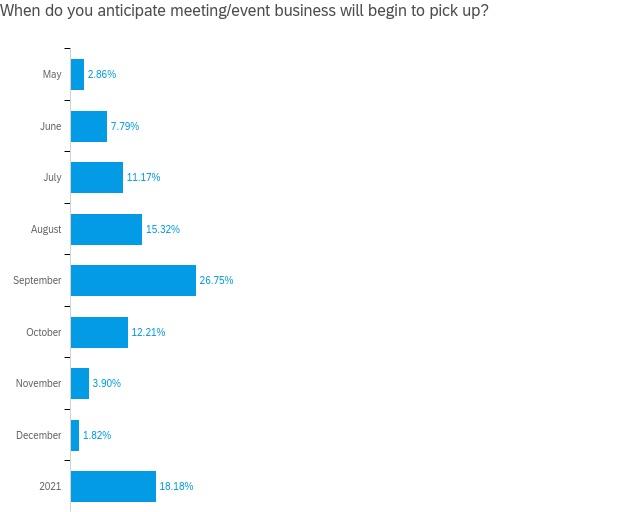

Asking meeting professionals to predict when recovery will happen is a mixed bag of insight from currently booked business as well as a distillation of news and hope. That said, 42% of respondents expect business to start picking up again in August (15%) or September (27%). While most meeting professionals, overall, think September will look good, planners are almost equally torn between that month (28%) and “Sometime in 2021” (27%).

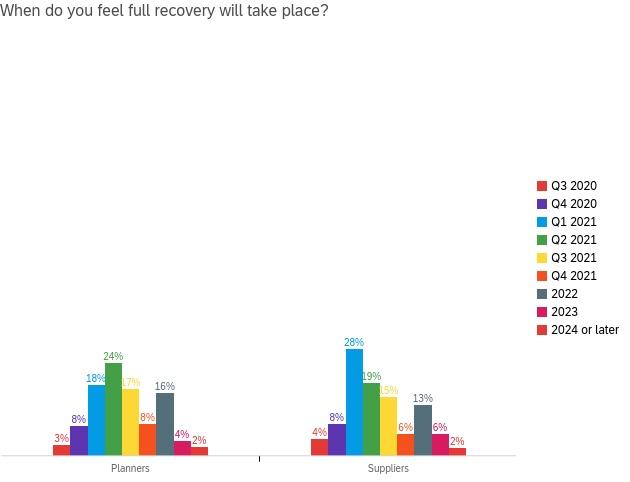

As for a timed target for full business recovery, meeting professionals are eyeing the first half of 2021—21% anticipate full recovery in Q1; 22% anticipate full recovery in Q2. In general, suppliers are expecting a slightly earlier recovery than planners.

Buying Window Fluctuations

Planners and suppliers are in lockstep when it comes to reporting how buying windows have changed as a result of the pandemic, with only minor various between those segments. 48% of planners indicate longer buying windows; 50% of suppliers indicate the same.

Changes to Perception of Destination/Venue Types

Presented with 23 types of destinations and venues, planner respondents reported those about which they’ve had the most positive or the most negative change in perception.

Seventy percent view “Online/Virtual” meetings in a more positive light than before the coronavirus pandemic, followed by “Shorter Distance from Home” and “Canada.”

Eighty-six percent view “Cruise Ships” in a more negative light than before the coronavirus pandemic, followed by “International” and “Asia-Pacific.”

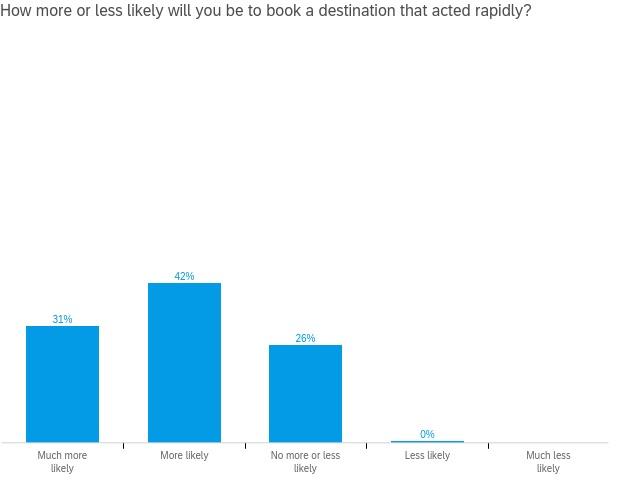

Planners’ perceptions of destinations have clearly been impacted by how destinations responded throughout the coronavirus pandemic, with 73% claiming a greater interest in such locations.

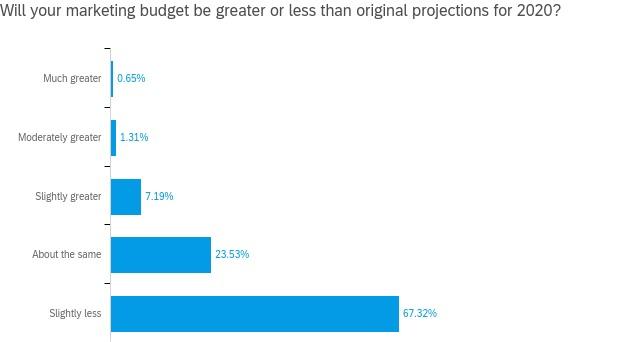

Suppliers’ Revenue and Marketing Hit

Based on the impact of the coronavirus, suppliers are expecting to realize 45% of their originally projected revenue for 2020, with the majority of respondents indicating smaller marketing budgets.