The latest survey by MPI's The Meeting Professional explored the near-future business landscape of a post-coronavirus world with an added focus on destination perceptions and use of CVBs. (April 13-27; 54% planners and 42% suppliers; 457 total)

Recovery Timing

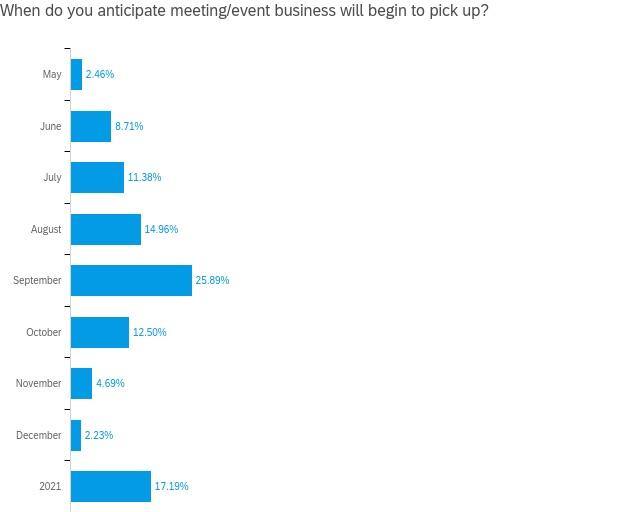

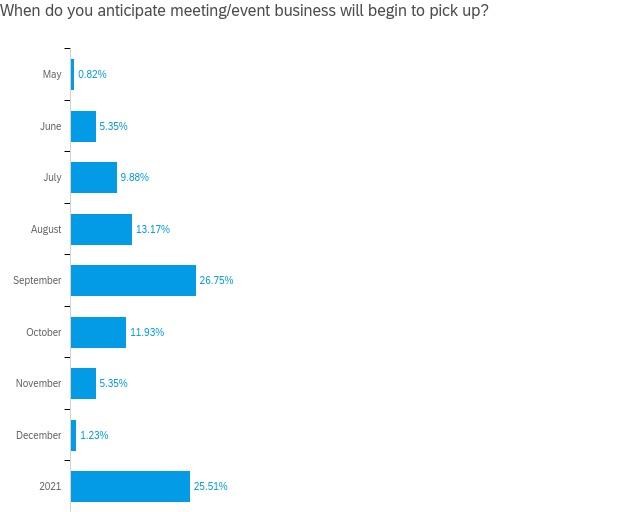

Asking meeting professionals to predict when recovery will happen is a mixed bag of insight from currently booked business as well as a distillation of news and hope. That said, 41% of respondents expect business to start picking up again in August (15%) or September (26%).

While most meeting professionals, overall, think September will look good, planners are almost equally torn between that month (27%) and “Sometime in 2021” (26%).

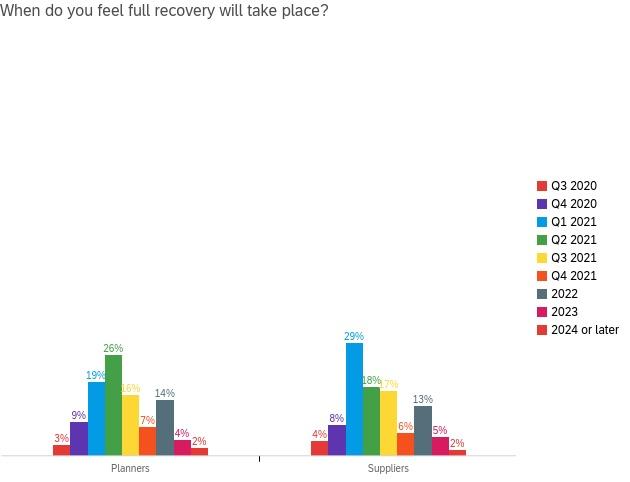

As for a timed target for full business recovery, meeting professionals are eyeing the first half of 2021—23% anticipate full recovery in Q1; 22% anticipate full recovery in Q2. In general, suppliers are expecting a slightly earlier recovery than planners.

Buying Window Fluctuations

Planners and suppliers are in lockstep when it comes to reporting how buying windows have changed as a result of the pandemic, with only minor various between those segments. 51% of planners indicate longer buying windows; 54% of suppliers indicate the same.

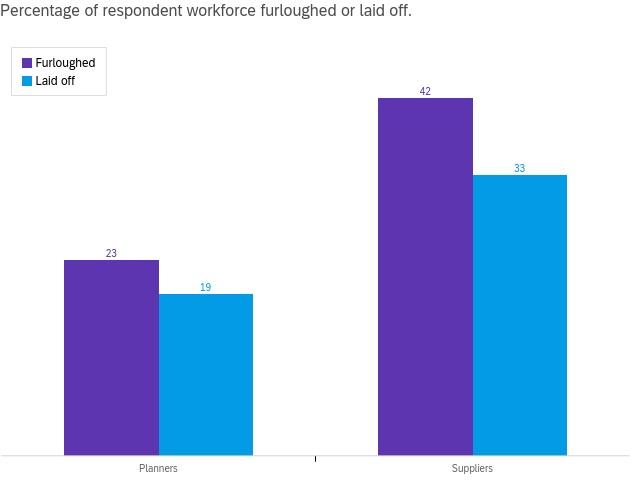

Furloughs and Layoffs

Overall, respondents report 58% of the staff at their organizations have been furloughed (32%) or laid off (26%). As horrific as those figures are, suppliers have been hit much harder with a total of 76% of staff furloughed (42%) or laid off (33%). [Planner respondents indicate 23% of staff furloughed and 19% laid off.]

Destination/Venue Perceptions

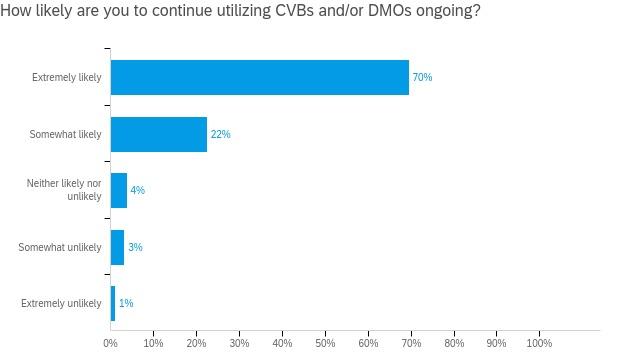

More than 78% of planner respondents have worked with CVBs or DMOs, and most will continue to leverage the benefits offered by such organizations.

Presented with 23 types of destinations and venues, planner respondents reported those about which they’ve had the most positive or the most negative change in perception.

70% view “Online/Virtual” meetings in a more positive light than before the coronavirus pandemic, followed by “Shorter Distance from Home” and “Canada.”

85% view “Cruise Ships” in a more negative light than before the coronavirus pandemic, followed by “International” and “Asia-Pacific.”

Planners’ perceptions of destinations have clearly been impacted by how destinations responded throughout the coronavirus pandemic, with 72% claiming a greater interest in such locations.

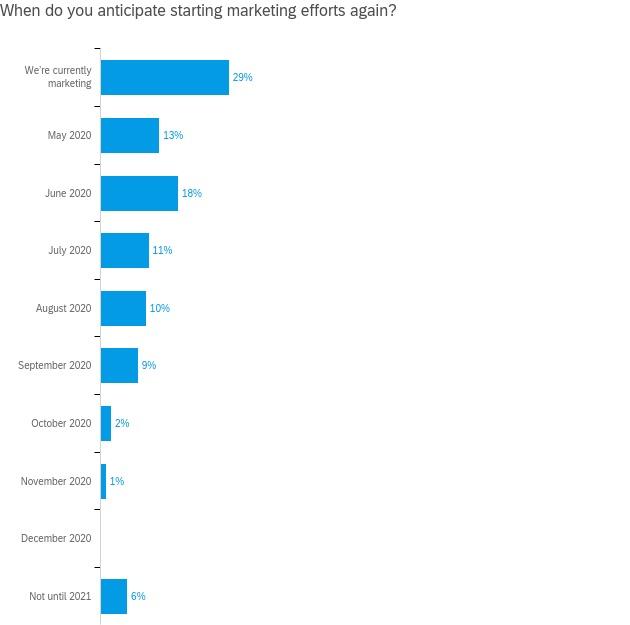

Suppliers’ Revenue and Marketing Hit

Based on the impact of the coronavirus, suppliers are expecting to realize 45% of their originally projected revenue for 2020, with the majority of respondents indicating smaller marketing budgets. Supplier marketing efforts: 29% say they’re currently marketing; 30% expect to begin marketing again before July. Only 6% expect to wait until 2021 before continuing marketing efforts.

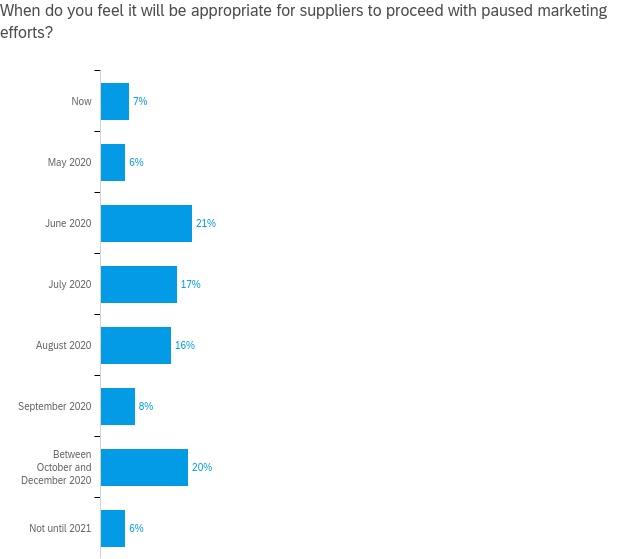

Meanwhile, planners believe it’s appropriate for suppliers to start marketing in June (21%)...or October to December (20%).

Essentially, suppliers are expecting a slightly earlier start to recovery than planners.

Meanwhile, 66% of suppliers anticipate marketing budgets in 2020 will be slightly less than original projections.

Download a two-page PDF with additional graphical data from this survey.

For the latest meeting and event industry news and information around the coronavirus, visit MPI’s Trusted Meeting & Event Resource page. Additionally, if you’d like to learn more about meetings and events in Puerto Rico, visit the survey’s sponsor Discover Puerto Rico.